My Turn: Quabbin redux — The reselling of New England’s Great River

The intake/outflow of the Northfield Mountain Pumped Storage Facilty using water from the Connecticut River. STAFF FILE PHOTO/PAUL FRANZ

| Published: 06-01-2024 11:28 PM |

I read FirstLight VP John Howard’s April 5 My Turn as a victory lap for a now 12 year-old Federal Energy Regulatory Commission relicensing bid for its river operations [“More public input sought in new phase of FirstLight relicensing”]. He touted the magnanimity in a grueling federal process, one slow-walked with FirstLight’s transglobal parent, $250 billion PSP Investments.

You don’t see glowing commentary from local officials stifled by FL nondisclosure agreements. They pushed stakeholders into drawn-out, dreary settlement terms. Montague recently appropriated $260,000 to fight FirstLight’s clawing back of tax revenues long tendered to satisfy impacts on Valley towns here.

Globally, PSP touts a commitment to pay the minimum amount of taxes required by law. A standard FirstLight negotiating reply has been quoted as “That’s a non-starter,” when public officials presented long-delayed spending proposals to fulfill license requirements. In 2012, FirstLight requested a combined single FERC license for its Northfield Mountain and Turners Falls operations. But as the 2018 endgame neared, they broke those assets into separate Delaware llc tax shelters, reducing levies to cash-strapped Franklin County towns.

PSP arrived in 2016, two years before those licenses would expire. Eight years on, backed by Van Ness Feldman their DC-based law/lobby, they’re profiting on an endlessly extended 1968 Northfield license. FirstLight reported $158 million in Northfield Mountain earnings in 2019. That’s a happy six-year windfall.

Last spring, along with Toronto Dominion Bank and Royal Bank of Canada, FirstLight established its own $97 million “green” lending bank. FirstLight’s bank now partners with New Leaf Energy, the outfit trying to shoehorn utility-scale solar into the forested hills surrounding Wendell and the Wendell State Forest.

FirstLight profits get exported far from this valley. Along with a handful of global outfits, they bid and won a $645 million long-term lease for thousands of ocean acres for wind farm development off New York and New Jersey. FirstLight also concluded leveraged buy-ups of traditional hydro companies in Pennsylvania, Ontario and Quebec, beefing up portfolio branding as a “clean” energy purveyor.

Yet Northfield, their river-ravaging “flagship” cash cow, has spent a decade dependent on climate-crippling gas dominating today’s power grid. ISO New England is today grandly subsidizing FirstLight’s net-energy-loss profit model.

Article continues after...

Yesterday's Most Read Articles

When FirstLight brags it could push out enough “stored” energy to power 1 million homes for up to seven hours, it leaves out the fact that Northfield is actually a huge energy consumer — that it would have already burned through the virgin grid energy of 1.34 million homes in order to do so. That’s just the baseline waste from a Trojan horse energy “solution.”

From summer’s last day through this January, Northfield was fully offline. It didn’t produce a watt of resale electricity. No one noticed; nobody spent holidays in the cold.

Four of FirstLight’s recent execs arrived after holding top jobs at the “quasi” public Massachusetts Clean Energy Center. And this March 26, FirstLight, along with MA Fish & Wildlife and MassDCR officials, got a private meeting with the MassDEP’s Office of Appeals and Dispute Resolution to smooth out issues in FirstLight’s required 401 Water Quality certification. That private confab came weeks before DEP finally announced dates for its long-promised “robust” public information sessions on the same issues.

Mr. Howard didn’t mention Northfield’s regularly suctioning the Connecticut to a dead stop, literally reversing miles of ancient current, ultimately yanked a further mile uphill to its reservoir. Nothing survives the trip. Hundreds of millions of eggs, young, and adult fish from dozens of species are obliterated annually.

In 2012, I asked Howard about the reversals. His non-denial answer to the stakeholder audience was: “Karl, when we pump, we pull from all directions.” Subsequent studies reveal that, for the calendar equivalent of three months annually, the river’s ancient current is reversed for a minimum of three miles, for hours, via its 15,000 cubic feet per second suction.

Boston’s Slowey McManus is shaping FirstLight’s public image. They also represent Walmart and now do PR for FirstLight’s biggest cheerleader in the bloated, corporate-dominated, bulk energy market: Holyoke-based (and also Delaware tax-sheltered) ISO-New England. ISO-NE is an energy marketer’s dream, never uttering a public whisper about consuming less in the face the climate crisis. At ISO, waste and consumption appear their climate solutions.

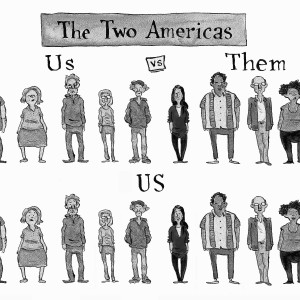

This insider market play has little to do with the modest energy needs here. It’s an energy shell game, with grim, long-term, valley environmental consequences. It ferries horrifically wasteful resale electricity from this ravaged river to over-consuming coastal towns and metro centers — reminiscent of the 1930s great Quabbin Valley pillage.

In the 1980s, an idea again arose to suction massive slugs from the Connecticut up Northfield’s tube and ship it as drinking water to quaff metro Boston’s profligate consumption. But towns and neighboring states here stood together, thwarting another ecosystem theft.

But, they’re back. Recently, ISO-New England and a dozen metro towns submitted letters of support to FERC for FirstLight’s bid to pull more life-extinguishing flow from New England’s critical central artery. Included were: Braintree, Groveland, Hingham, Wellsley, Merrimac, Norwood, Middleton, Belmont, Stowe, Rowley, North Attleboro and Taunton.

All had formerly purchased “renewable energy credits” via FirstLight’s Connecticut River operations. Whether for energy-gobbling for data mining, empty office towers, sports bets, venture-capital genetics, or casinos: Boston and its tony suburbs will again happily farm out massive energy consumption responsibilities by reaching west to suck life from a crippled, four-state Connecticut, a river with literally no more to give.

Karl Meyer of Greenfield is a member of the Society of Environmental Journalists.

The World Keeps Turning: Free speech is a cornerstone of America

The World Keeps Turning: Free speech is a cornerstone of America My Turn: First, they came for the idea of the common good

My Turn: First, they came for the idea of the common good Letter: Striking Parallels to Nazism

Letter: Striking Parallels to Nazism Linda and Bill Oldach: Grosky for selectman

Linda and Bill Oldach: Grosky for selectman